How Does VisionVantage Compare with Common Vision Insurance Providers?

By Dr. Theresa Pham • December 11, 2025

As health insurance premiums spiked in 2025, vision insurance is quietly following the same pattern. Premiums are rising, networks are narrowing, and more employers are separating vision coverage from medical plans.

If you're worried about rising vision insurance costs or exploring your options for 2026, Fuquay Eye Care offers an alternative worth considering: VisionVantage, a membership program that delivers significantly more value than traditional vision insurance.

In this blog, we explore how traditional vision insurance providers like VSP and EyeMed actually work, what the hidden costs are, and how VisionVantage's membership model compares.

Whether you're keeping your current insurance or looking for an alternative, understanding the real value of vision benefits can help you make the best choice for your family.

What Are the Most Common Vision Insurance Providers?

When people think about vision insurance providers, two names dominate: VSP and EyeMed. These vision insurance companies control the majority of the market, with VSP as the nation's largest vision insurance provider and EyeMed serving tens of millions of members.

You'll also see other vision insurance providers like Aetna Vision Insurance, Principal Vision Insurance, and Humana Vision Insurance, but VSP and EyeMed are the plans most employers offer.

These traditional vision insurance providers follow the same basic model: you (or your employer) pay monthly premiums, then you pay copays when you use the benefits, and you receive an "allowance" toward frames or contacts. The model sounds straightforward, but the actual value delivered often falls short of expectations.

How Traditional Vision Insurance Works (VSP and EyeMed)

Let's break down what you actually get with vision insurance provider VSP or EyeMed vision insurance:

Exam Copays: Even with insurance, you'll pay copays for eye exams at in-network providers. These copays are on top of the monthly premiums already being paid.

Routine Imaging Fees: Most in-network providers now require imaging fees for comprehensive exams. These fees are charged in addition to your exam copay and are not typically covered by your vision plan.

Allowance-Based Benefits: Vision plans offer an "allowance" toward frames or lenses. However, allowances cap your benefit while you still pay out-of-pocket for anything beyond that amount. If you want specific frames, premium lens materials, or upgrades (anti-glare coating, transitions, progressives), you'll pay additional costs that quickly add up.

Network Restrictions: Both VSP and EyeMed require you to use in-network providers to receive full benefits. This limits your choices and means you must use labs and providers within their network—even if better options exist elsewhere.

Frequency Limits: VSP and EyeMed restrict how often you can use benefits, with typical waiting periods of 12-24 months between exams, frames, or lenses. Need a second pair of glasses this year? You're paying full price with no insurance benefit.

Medical Care Exclusions: Here's a critical limitation most people don't realize: vision care plans only cover routine vision care—they don't cover medical eye problems. If you experience eye infections, foreign body removal (like metal in the eye), contact lens-related complications, glaucoma treatment, or other medical eye conditions, your vision insurance won't help. You'll need to use your medical insurance instead, which means separate deductibles, copays, and out-of-pocket costs. This significantly reduces the value of vision insurance when you actually need eye care for medical issues.

Lab Quality Concerns: VSP and EyeMed require that your glasses be manufactured at labs they own and operate. Many practices have found that these corporate-owned labs have slower turnaround times, more errors, and less responsive customer service compared to privately-owned labs. The high volume these corporate labs process means less attention to individual orders and quality control.

The Real Cost-Benefit Analysis

Here's what most people don't realize: when you factor in all the costs and restrictions, traditional vision insurance providers deliver minimal net value.

According to industry analysis comparing total costs (premiums, copays, imaging fees, and out-of-pocket expenses) against actual benefits received:

VSP and EyeMed Net Annual Value: -$22 to $64 per year

That's right—even in the best-case scenario, you're only getting about $64 in net value after paying all the premiums, copays, and fees. In many cases, you're actually losing money on the coverage.

The core issue is layered costs combined with restrictions:

- Monthly premiums (even if employer-paid, that's part of your total compensation)

- Exam copays every visit

- Routine imaging fees

- Allowance caps that don't cover the full cost of quality eyewear

- Frequency limits that force you to pay full retail if you need care outside the 12-24 month windows

- Reduced quality and slower service from corporate-owned labs

This is why "vision insurance worth it" discussions consistently raise the same point: for many people, traditional vision care insurance delivers far less value than expected once all the costs and restrictions are factored in.

VisionVantage Is Different from Vision Insurance Providers

VisionVantage is a membership program at Fuquay Eye Care designed to eliminate the hidden costs, restrictions, and quality concerns of traditional vision insurance.

Here's what makes it different:

No Exam Copays: When you visit Fuquay Eye Care with your VisionVantage membership, there are no exam copays. Zero. You get comprehensive eye exams without the out-of-pocket expense you'd pay with VSP or EyeMed.

No Routine Imaging Fees: VisionVantage eliminates routine imaging fees. You get the diagnostic technology you need as part of your comprehensive care, not as an add-on charge.

No Frequency Limits: Need an exam every 6 months? Want three pairs of glasses this year? VisionVantage has no frequency restrictions. You can use your benefits as often as your vision care needs require—no 12-24 month waiting periods.

Transparent Percentage Discounts: Instead of navigating confusing allowance caps and exclusions, VisionVantage offers straightforward discounts on services and products at Fuquay Eye Care:

- 20% off individual eye exams, 25% off family member exams

- 25% off all glasses (frames and sunglasses)

- 30% off lenses

- 10% off standard contact lens fittings

- No limit on number of pairs

Superior Lab Quality: VisionVantage gives you access to privately-owned labs that Fuquay Eye Care partners with—not corporate-owned facilities processing thousands of orders daily. These private labs deliver:

- Faster turnaround times (lower volume means your order gets priority attention)

- Better customer service (direct relationships, not call centers)

- Fewer errors (higher quality control standards)

- More personalized care throughout the process

Included Warranty: VisionVantage includes a free 1-year warranty on all optical purchases and a 3-month prescription guarantee with free remake if needed—benefits that VSP and EyeMed charge deductibles for.

The Bottom Line on Value: VisionVantage delivers $520-$560 in net annual value compared to VSP/EyeMed's -$22 to $64. That's a difference of $456-$582 per year in your favor.

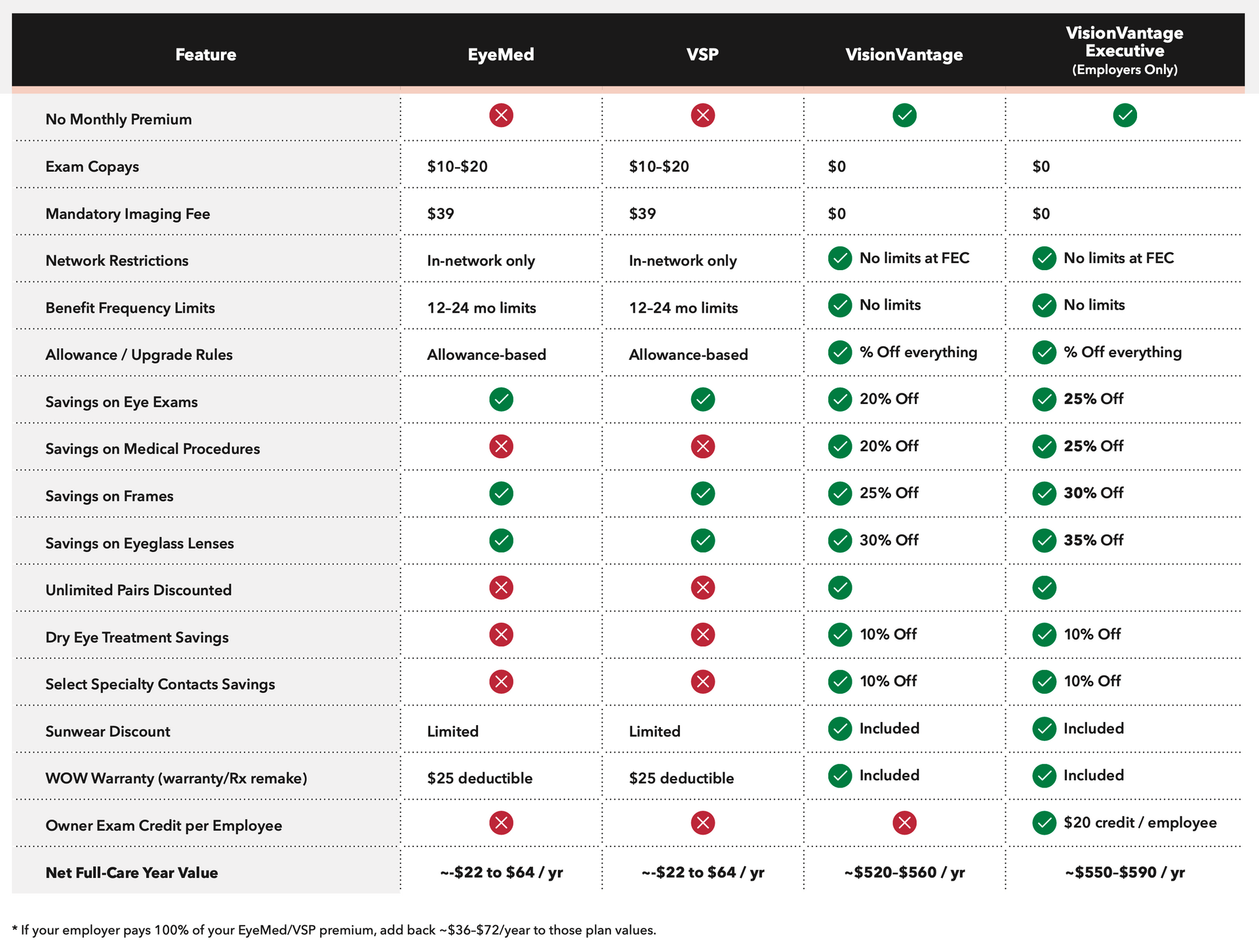

Side-by-Side Comparison: VSP vs EyeMed vs VisionVantage

What If You Have A Vision Coverage Provider in 2026?

If you've already enrolled in or paid for VSP or EyeMed coverage for 2026 through your employer, here's a smart strategy:

Keep your current coverage for 2026, since you've already paid for it. But also consider joining

VisionVantage to access discounts on services that vision insurance doesn't cover well:

- Medical eye procedures (20% off with VisionVantage)

- Specialty care and treatments

- Additional pairs of glasses beyond frequency limits

- Premium services and products

Then, when your employer's open enrollment comes around for 2027, you can opt out of the vision insurance plan and rely solely on VisionVantage—saving both you and your employer money while getting better value.

Is Vision Insurance Worth It in 2026?

The data is clear: traditional vision insurance from VSP or EyeMed delivers minimal net value—often breaking even or resulting in a small loss even when factoring in employer contributions.

Add in the restrictions, copays, imaging fees, frequency limits, and lab quality concerns, and the value proposition becomes even weaker.

VisionVantage offers:

- No copays at Fuquay Eye Care

- No imaging fees

- No frequency restrictions

- Transparent percentage discounts

- Superior lab quality and service

- $520-$560 in net annual value (vs. VSP/EyeMed's -$22 to $64)

For families in the Fuquay area, the choice is straightforward. VisionVantage eliminates the hidden costs and restrictions of traditional vision insurance while delivering significantly better value and quality.

The question isn't whether you need vision care—you do. The question is whether paying insurance premiums and navigating copays, fees, and restrictions makes sense when a membership with transparent benefits and superior service delivers far more value.

Ready to see the difference? Contact Fuquay Eye Care to learn more about VisionVantage membership and get a personalized comparison based on your family's vision care needs.

Discounts?

Yes please!

Get more info about our VisionVantage program for discounted rates on services and eye wear.

Contact Us

We will get back to you as soon as possible.

Please try again later.

SHARE THIS